Clipping Board » Other ─ There is currently no cure for this disease of the country and society...

United Daily News reporters Chen Su-ling, Hsu Pi-hua, Su Hsiu-hui

United Daily News reporters Chen Su-ling, Hsu Pi-hua, Su Hsiu-hui

Photo provided by United Daily News

When it comes to financial black holes, the hidden debt of the military, civil servants, and teachers' retirement system is truly alarming. The combined old and new retirement systems amount to nearly 8 trillion NTD, even larger than the Labor Insurance Fund. However, retired teacher Zhang isn’t worried at all: "I believe the Republic of China government won’t collapse in my lifetime."

Professor Lin Wan-yi from the Department of Sociology at National Taiwan University explains that Labor Insurance and the retirement system are different. The liabilities of Labor Insurance are borne by the next generation of contributors, while the military, civil servants, and teachers externalize the costs, shifting the burden to the entire population. "It’s you and me paying taxes so that military personnel, civil servants, and teachers can receive their monthly pensions."

The government’s proposed reform plan for military, civil servants, and teachers is a drop in the bucket for the financial black hole. According to the Executive Yuan’s announced version, the 18% preferential interest rate will be reduced to 9%, and the calculation base of "base salary × 2" will be lowered to "base salary × 1.6." Teacher Zhang’s monthly pension will drop from 68,000 NTD to 49,000 NTD. Teacher Zhang says, "I’m prepared. I know what happened in Greece—pensions will definitely shrink."

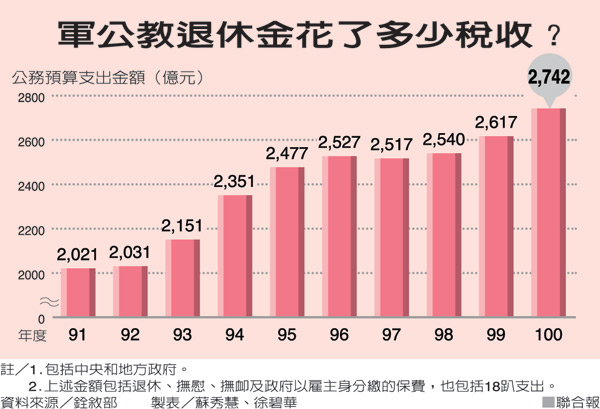

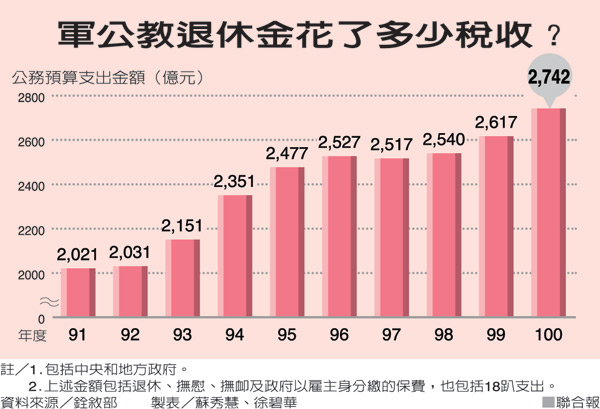

How much have taxpayers paid? According to data from the Ministry of Civil Service, in 2011, the central and local governments spent 274.2 billion NTD from the public budget on military, civil servants, and teachers’ retirement benefits. How big is 274 billion NTD? In the same year, individual income tax revenue was 343 billion NTD, meaning retirement benefits accounted for about 80% of income tax revenue.

Lu Ming-tai, Director of the Retirement and Pension Department under the Ministry of Civil Service, stated that out of the 274 billion NTD, about 37 billion NTD was the government’s contribution as an employer, while the vast majority was used to pay pensions, including the 18% preferential interest.

Over the past decade, approximately 2 trillion NTD from the public budget has been directly allocated to military, civil servants, and teachers’ pensions. Labor groups have long felt that the government is too biased, allocating large budgets annually to supplement these pensions, while not contributing a single cent to the Labor Insurance Fund for decades.

Why does it cost so much? Lu Ming-tai explains that Taiwan has two unique expenses not found in military, civil servants, and teachers’ systems worldwide. The first is survivor benefits—while pensions elsewhere end upon death, in Taiwan, the spouse can continue receiving half the pension after the insured’s death. Originally, this was to be abolished in the reform, but due to opposition, it was reduced from half to one-third. The second is the 18% preferential interest, which costs 80 to 90 billion NTD annually.

Chen Hsiao-hung, Deputy Minister of the Council for Economic Planning and Development, points out that "early retirement" is another unique phenomenon. Early retirement means shorter contribution periods and longer pension payout periods. According to statistics from the Pension Fund Management Committee, in 2011, the average retirement age for civil servants was 55.2 years, for educators 53.94 years, and for military personnel 43.65 years. Compared to other countries, Taiwan’s military, civil servants, and teachers can receive pensions for roughly ten more years.

The most critical reason is the high income replacement rate for military, civil servants, and teachers. "In Taiwan, those with seniority under the old system have an income replacement rate of 90% to 100%." The pension they receive is almost the same as their salary while working.

Source: http://vision. udn. com/ storypage. jsp? f_ART_ID=1471

Pension Fund Deficit Covered by Tax Revenue for Civil Servants and Military Personnel

Photo provided by United Daily News

When it comes to financial black holes, the hidden debt of the military, civil servants, and teachers' retirement system is truly alarming. The combined old and new retirement systems amount to nearly 8 trillion NTD, even larger than the Labor Insurance Fund. However, retired teacher Zhang isn’t worried at all: "I believe the Republic of China government won’t collapse in my lifetime."

Professor Lin Wan-yi from the Department of Sociology at National Taiwan University explains that Labor Insurance and the retirement system are different. The liabilities of Labor Insurance are borne by the next generation of contributors, while the military, civil servants, and teachers externalize the costs, shifting the burden to the entire population. "It’s you and me paying taxes so that military personnel, civil servants, and teachers can receive their monthly pensions."

The government’s proposed reform plan for military, civil servants, and teachers is a drop in the bucket for the financial black hole. According to the Executive Yuan’s announced version, the 18% preferential interest rate will be reduced to 9%, and the calculation base of "base salary × 2" will be lowered to "base salary × 1.6." Teacher Zhang’s monthly pension will drop from 68,000 NTD to 49,000 NTD. Teacher Zhang says, "I’m prepared. I know what happened in Greece—pensions will definitely shrink."

How much have taxpayers paid? According to data from the Ministry of Civil Service, in 2011, the central and local governments spent 274.2 billion NTD from the public budget on military, civil servants, and teachers’ retirement benefits. How big is 274 billion NTD? In the same year, individual income tax revenue was 343 billion NTD, meaning retirement benefits accounted for about 80% of income tax revenue.

Lu Ming-tai, Director of the Retirement and Pension Department under the Ministry of Civil Service, stated that out of the 274 billion NTD, about 37 billion NTD was the government’s contribution as an employer, while the vast majority was used to pay pensions, including the 18% preferential interest.

Over the past decade, approximately 2 trillion NTD from the public budget has been directly allocated to military, civil servants, and teachers’ pensions. Labor groups have long felt that the government is too biased, allocating large budgets annually to supplement these pensions, while not contributing a single cent to the Labor Insurance Fund for decades.

Why does it cost so much? Lu Ming-tai explains that Taiwan has two unique expenses not found in military, civil servants, and teachers’ systems worldwide. The first is survivor benefits—while pensions elsewhere end upon death, in Taiwan, the spouse can continue receiving half the pension after the insured’s death. Originally, this was to be abolished in the reform, but due to opposition, it was reduced from half to one-third. The second is the 18% preferential interest, which costs 80 to 90 billion NTD annually.

Chen Hsiao-hung, Deputy Minister of the Council for Economic Planning and Development, points out that "early retirement" is another unique phenomenon. Early retirement means shorter contribution periods and longer pension payout periods. According to statistics from the Pension Fund Management Committee, in 2011, the average retirement age for civil servants was 55.2 years, for educators 53.94 years, and for military personnel 43.65 years. Compared to other countries, Taiwan’s military, civil servants, and teachers can receive pensions for roughly ten more years.

The most critical reason is the high income replacement rate for military, civil servants, and teachers. "In Taiwan, those with seniority under the old system have an income replacement rate of 90% to 100%." The pension they receive is almost the same as their salary while working.

Source: http://vision. udn. com/ storypage. jsp? f_ART_ID=1471